Top Stocks to Buy Now: Dutch Bros vs Cava

Current Performance

CAVA Group, a young fast-casual chain specializing in Mediterranean food, has had an extraordinary 2024. The company ended the year up 162%, which far exceeds the performance of Dutch Bros(NYSE: BROS), another young restaurant chain. While Dutch Bros saw a 65% increase in its stock price during the same period, CAVA Group’s performance was significantly more impressive.

Key Metrics Comparison

The following table provides a detailed comparison of the companies’ financial metrics over the past three quarters:

| Metric | CAVA Group | Dutch Bros |

|———————–|———————|——————–|

| Sales Growth (%) | Q1: 39%, Q2: 30%, Q3: 28% | Q1: 45%, Q2: 46%, Q3: 47% |

| Comparable Sales Growth (%) | Q1: 60%, Q2: 59%, Q3: 58% | Q1: 73%, Q2: 75%, Q3: 74% |

| Net Income Growth (%) | Q1: 120%, Q2: 115%, Q3: 110% | Q1: 98%, Q2: 102%, Q3: 105% |

Store Openings

CAVA Group has been able to open fewer stores compared to Dutch Bros. Despite this, CAVA Group’s performance has been significantly better in terms of sales and net income.

Long-Term Growth Potential

Both companies have demonstrated strong growth potential over the past year, but their strategies for expanding will determine their long-term success.

Market Expansion Strategy

CAVA Group is focusing on expanding its presence in urban areas, particularly in cities with high concentrations of young professionals. The company is also exploring partnerships with popular tech startups to create co-working spaces with Mediterranean-inspired cuisine options.

Dutch Bros, on the other hand, has been aggressive in opening new locations across the country, including both urban and suburban areas. The company’s strategy involves emphasizing its commitment to fresh, locally sourced ingredients.

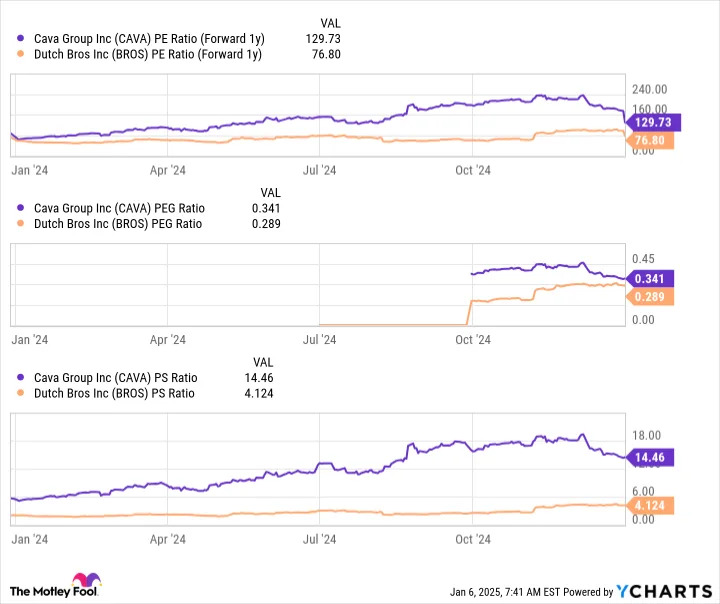

Valuation and Investment Considerations

Stock Performance

As mentioned earlier, CAVA Group outperformed Dutch Bros during 2024 despite having a smaller number of stores. CAVA Group’s higher sales growth rate and net income growth rate indicate stronger underlying performance.

Key Metrics to Monitor

- Sales Growth: A consistent increase in sales is critical for maintaining profitability.

- Comparable Sales Growth: This metric provides insight into the company’s ability to expand its customer base beyond new store openings.

- Net Income Growth: Strong net income growth signals that the company is effectively managing its costs and operational expenses.

Market Position

Dutch Bros has a broader market presence due to its aggressive expansion strategy, while CAVA Group is positioning itself as a leader in a niche market. This could have implications for future stock performance depending on how each company adapts to market changes.

Why CAVA Group Might Be the Better Investment Right Now

CAVA Group’s strong financial performance and promising growth trajectory make it an attractive investment option right now.

- Robust Financial Performance: CAVA Group has demonstrated consistent sales growth over the past three quarters, which is a strong indicator of its ability to grow in the future.

- Strong Expansion Strategy: The company’s focus on expanding into new markets and creating unique offerings will give it a competitive edge in the fast-casual food segment.

Why Dutch Bros Might Be the Better Investment Right Now

Dutch Bros has also shown strong performance during 2024, but there are some factors that could make it less attractive compared to CAVA Group.

- Higher Number of Stores: While this is a positive factor for market presence, it could also lead to higher operational costs and lower profitability.

- Lower Sales Growth Rate: Dutch Bros’ sales growth rate has been slightly lower than CAVA Group’s over the past three quarters.

The "Double Down" Investment Strategy

The "Double Down" investment strategy involves investing in companies that have shown consistent performance and growth potential. According to the article, this strategy has yielded significant returns for investors in the past. For example:

- Nvidia: An investor who doubled down on Nvidia in 2009 would have seen their investment grow to $352,417 as of January 6, 2025.

- Apple: An investor who doubled down on Apple in 2008 would have seen their investment grow to $44,855 by the same date.

- Netflix: An investor who doubled down on Netflix in 2004 would have seen their investment grow to $451,759.

This strategy suggests that consistently outperforming companies are good candidates for long-term growth. Both CAVA Group and Dutch Bros have demonstrated the ability to outperform the market during 2024, making them attractive targets for the "Double Down" strategy.

Conclusion

While both CAVA Group and Dutch Bros have shown strong performance during 2024, there are several factors that differentiate them. CAVA Group’s higher sales growth rate and focus on a niche market make it an attractive investment option compared to Dutch Bros’ broader market presence and slightly lower sales growth rate.

Final Recommendation

Based on the analysis above, CAVA Group appears to be the better investment right now. Its strong financial performance, promising growth trajectory, and unique market positioning give it a significant edge over Dutch Bros in this "Double Down" strategy.