Get the Best Currency Exchange Rates with iChange: A Digital Wallet Plus Real-World Money Exchange

iChange positions itself as a digital wallet and currency-changing marketplace designed for travelers who demand real-money exchange rates and convenient cross-border features. After a month-long trial, this report provides a thorough, data-driven look at how iChange compares with other popular services, its sign-up process, rate transparency, and everyday usability. The review consolidates firsthand experiences across digital and physical exchanges, detailing the platform’s strengths, limitations, and practical tips for travelers and frequent foreign spenders.

What is iChange?

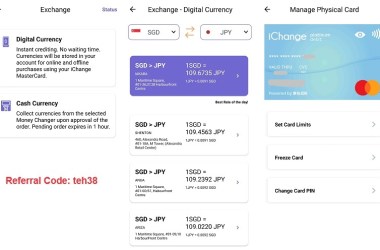

iChange is presented as a multi-faceted financial platform that blends a money-changing marketplace with a digital wallet supporting multiple currencies, a physical debit card, overseas money transfers, and integrated local and overseas bill payments. The service is positioned as an alternative to well-known fintech apps such as YouTrip and Revolut, with a distinctive emphasis on connecting users to real-money currency changers to secure market-leading rates rather than relying solely on in-app wholesale rates. The platform aggregates a curated list of currency shops where users can obtain exchange quotes, then allows customers to complete exchanges either digitally through the app or by presenting the transaction at a partner shop.

From a structural standpoint, iChange operates as a digital wallet that holds funds in multiple currencies and offers a Mastercard-backed debit card linked to the wallet. The app’s core functionality centers on three pillars: currency exchange (digital and in-person), money movement (sending funds overseas), and the ability to manage multiple currencies within a single wallet. In addition to currency conversion, iChange supports local and overseas bill payments, giving travelers a consolidated solution for everyday financial needs while abroad. The platform emphasizes the safety and integrity of funds by describing a regulated framework for fund storage and payment processing, aligning with industry standards for consumer protection.

On the operational side, iChange markets itself as a service that enables users to switch currencies digitally within the app and to execute physical exchanges at partner currency shops. The dual approach aims to give customers the flexibility to choose the most favorable rate and the most convenient method, depending on the user’s location and immediate needs. The app claims to display multiple exchange options for a given currency, enabling users to select among competing quotes, while also warning that some shops may occasionally lack sufficient stock to fulfill a requested amount. When stock is insufficient at a preferred shop, users can opt for the next-best option within the queue of available rates.

For readers familiar with digital wallets and mobile money services, iChange shares a comparable feature set with established apps but adds a tangible market dynamic by tying digital quotes to real-world currency shops. This creates a hybrid experience: a digital interface that connects to physical currency providers in the real world, potentially enabling users to take advantage of favorable in-store rates while maintaining the convenience of digital wallet features. In practice, this means travelers can monitor live exchange quotes within the app, determine whether a physical shop can fulfill the order, and then either complete the transaction in-app or proceed to the partner location to finalize the exchange.

Moreover, iChange’s ecosystem includes a physical Mastercard debit card issued after sign-up, enabling card-based purchases in local currencies drawn from the wallet balance. The card is designed to work seamlessly with the digital wallet, so users can rely on the card to spend funds as needed, with the wallet serving as the primary source of currency. The combination of a digital wallet and a linked debit card mirrors common fintech models, but the distinguishing feature remains the gateway through which users access real currency shops to secure favorable exchange rates. The platform also emphasizes security measures and regulatory oversight, describing funds as deposited with a licensed bank partner under local regulatory supervision and processed through established payment networks.

In summary, iChange is best understood as a comprehensive travel-centered financial platform that blends a multi-currency wallet, a real-money currency marketplace, a physical debit card, and cross-border payment capabilities. It positions itself as a practical alternative for travelers who want transparent rate quotes from real currency shops, alongside the convenience of digital wallet management and card-based spending. The combination of digital and in-person exchange options is intended to offer users more control over rates and timing, which can be particularly valuable in volatile currency markets or during travel when timely access to local currencies matters.

Rates, Exchanges, and Real-World Observations

A core claim of iChange is access to favorable exchange rates through real-money currency shops, rather than relying solely on algorithm-driven, in-app rate feeds. In practice, the platform presents multiple rate options for a given currency, allowing users to pick the most advantageous quote available at that moment. While this approach can yield better outcomes than static app-based rates, it also introduces a logistical variable: not every shop may have the requested currency or the exact amount in stock at all times. When stock is insufficient at the first-choice shop, users may be guided to select alternative quotes, which can still deliver competitive rates, albeit with a longer path to completion.

A real-world example observed during a trial period centered on the Japanese Yen (JPY) versus the Singapore Dollar (SGD). With prevailing market sentiment often affecting yen strength, the timing of exchanges becomes crucial for travelers. The iChange app illustrated a rate environment that, for Yen, could present favorable opportunities when the yen displayed weakness, making it an ideal moment to exchange. This is consistent with common currency market behavior: when a currency is weaker, traders and travelers alike can benefit from more favorable exchange rates. For context, a comparison was made against a prominent benchmark used by many travelers and traders—an established currency-tracking service that residents typically rely on to gauge rate movements. The observed takeaway was that iChange often provided a competitive edge by surfacing rates that aligned with or exceeded those benchmark references.

In parallel observations, the platform offered multiple rates by listing several shops that could supply Yen at varying prices. The user could view the quotes side by side and select the most favorable option. This approach is advantageous for users who want to optimize value, especially for large currency exchanges or for funding travel budgets ahead of trips. However, the system’s transparency hinges on consistently updating rate data and ensuring that the displayed quotes reflect actual, verifiable stock in the chosen shop. Users must also understand that some shops may refuse or fail to fulfill an order if stock is unavailable, requiring the user to pivot to an alternative quote or a different venue.

Beyond Yen, the iChange ecosystem supports a broad roster of frequently traded currencies. Among them, the Malaysian Ringgit (MYR) has been cited as a particularly popular option within the app’s user base. In this case, the exchange rate featured in the app demonstrated strong competitiveness, with a rate example around 3.4659 MYR per 1 SGD during late September observations. Such figures illustrate the potential for iChange to deliver favorable outcomes for travelers who require quick access to regional currencies when crossing borders or transacting in foreign markets. The availability of widely traded currencies in the platform’s catalog is a critical component of its appeal, as users are more likely to find familiar currencies with reliable liquidity.

An important practical consideration for rate-driven exchange is the distinction between digital wallet exchanges and physical shop transactions. When a user plans to exchange currency at a physical shop, it’s essential to verify that the shop accepts the selected rate and can complete the transaction as requested. In the observed cases, iChange’s interface displayed the rate and allowed the user to initiate the process through the app, often followed by a PayNow or similar payment method. The shop then completed the exchange, and the user received the targeted currency according to the quoted rate. This process underscores the need for accurate, real-time communication between the app and the shop, ensuring that the rate quoted in-app corresponds to the actual cash or digital transfer delivered at the point of sale.

From a user experience perspective, rate transparency and stock availability are two of the most critical factors shaping satisfaction with iChange. The app’s ability to present several competing quotes provides travelers with meaningful choice, but it also necessitates clear messaging when stock limitations affect execution. In practice, this means that users should be prepared to adapt quickly, perhaps by selecting an alternative currency shop or accepting the next-best rate if the preferred option cannot fulfill the order. The overall takeaway is that iChange can offer competitive rate access and flexible execution methods, but travelers should approach exchanges with a plan that accounts for potential stock constraints and timing considerations.

To summarize rate dynamics, iChange’s approach of presenting multiple real-world quotes from partner currency shops is designed to maximize rate opportunities for users. The platform’s valuation is enhanced when it accurately reflects live stock levels and ensures that the quoted rates translate into successful, tangible currency delivery. This requires robust synchronization between the app’s rate feeds, shop inventories, and payment methods used to finalize exchanges. While the system has demonstrated practical efficacy in the observed sessions, users should remain mindful of rate volatility, the possibility of stock shortages, and the time required to complete a physical-exchange transaction when choosing the best path to obtain foreign currency.

Sign-Up and Onboarding: Steps, Timing, and Early Experience

Signing up for iChange involves a straightforward onboarding process that mirrors the flow common to many fintech services while introducing some unique aspects tied to currency exchange functionality. Prospective users begin by downloading the iChange app from major app stores, available for both Android and iOS. The initial phase requires entering personal information to establish an account, followed by verification steps. The process appears to integrate a government-backed verification method in markets where Singpass is available, enabling users to retrieve their profile data securely and quickly. This approach can significantly reduce onboarding friction and speed up the time to first use, allowing new accounts to become operational within a short window after submission.

Following the completion of the sign-up process, most users can begin utilizing the digital wallet features almost immediately. In many cases, a physical iChange Mastercard is issued and mailed to the user a few days after the account is activated. The card is designed to function as a debit instrument linked to the multi-currency wallet, enabling card-based transactions in the currency supported by the wallet’s balance. The availability of a physical card adds a familiar, tangible spending option for travelers who prefer card payments over cash or digital wallet transactions in certain contexts. The seamless pairing of a digital wallet with a physical card enhances user flexibility and broadens use-case scenarios, particularly when shopping in places that may not accept mobile wallets or when offline trust in card networks is preferred.

An important onboarding consideration is the potential use of referral programs. Anecdotal experiences from early users describe referrals as a possible incentive mechanism, including benefits that may appear upon successful sign-up. While such programs can be attractive, they also introduce complexities related to referral attribution and payout timing. For example, a user’s experience might include multiple referral attempts with varying outcomes, where only a portion of attempts result in wallet credits or rewards. Prospective users should be aware that referral dynamics can differ across regions and over time, and that signing up without participating in referral opportunities remains a straightforward path to utilization. The onboarding journey ultimately emphasizes speed, security, and accessibility, with a clear pathway to start using both the digital wallet and the physical card once verification and issuance steps are completed.

During the onboarding, users should anticipate a few typical steps: entering basic personal information, confirming identity through a verification flow, and granting necessary permissions for app functionality. Once the initial steps are completed, users gain access to the wallet’s multi-currency capabilities, where funds can be held in different currencies and managed through the app interface. In many cases, users will receive a physical card within a few days, enabling immediate practical usage for in-person purchases and travel-related expenditures. The onboarding experience is designed to be comprehensive yet streamlined, ensuring that even first-time users can begin using the platform with minimal delay while maintaining robust security and compliance with financial regulations.

In summary, the sign-up and onboarding process for iChange integrates a familiar fintech pattern—download, register, verify, and receive a linked debit card—while emphasizing the platform’s currency-exchange functionality and regulatory-backed safety measures. The timeline from download to first use is typically measured in days, with the physical card arriving shortly after verification and activation. While onboarding may include optional referral-based incentives, the core value proposition remains anchored in quick access to a multi-currency wallet, real-time exchange quotes from partner shops, and convenient card-based spend in various currencies.

Digital Wallet Usage, In-Person Exchanges, and Everyday Transactions

The practical use of iChange spans online purchases, in-person exchanges, and everyday transactional scenarios across multiple currencies. In one routine test, the digital wallet was employed for online purchases denominated in USD, taking advantage of the wallet’s ability to store and spend funds without the need to first convert to the local currency at the point of sale. This approach demonstrated smooth operation, with transactions completing as expected within the digital environment. It also highlighted the convenience of using a single wallet to manage funds in multiple currencies, simplifying budgeting for international shopping or services that bill in USD. This digital-flow capability is particularly valuable for travelers who want to lock in favorable exchange conditions for online purchases before departure or upon arrival at a destination with robust e-commerce options.

In Singapore, the platform’s physical card showcased automatic currency routing; when a purchase was made, the card automatically drew funds from the SGD balance held in the e-wallet, effectively translating the transaction into the local currency of the purchase. The seamless integration between wallet balances and card transactions helps minimize friction during daily activities, from dining to transit, while ensuring that spend is recorded in the correct currency for easy reconciliation. This automatic currency selection reduces the cognitive load on travelers who often contend with multiple currencies in their wallets, and it aligns with consumer expectations for quick, predictable checkout experiences.

Looking ahead, there is anticipation for expanded use in international contexts, such as Japan, where currency dynamics and merchant acceptance can vary significantly. The author indicated plans to deploy the platform in Japan in the upcoming week, with a commitment to provide an updated assessment following firsthand usage. This forward-looking stance underscores the platform’s potential to support travelers who require real-time, reliable access to local currencies and streamlined payment options in foreign markets.

In terms of currency exchanges, the author performed several digital exchanges within the app, covering USD, Korean Won (KRW), and Japanese Yen (JPY). The digital exchange experience for these currencies appeared efficient, with the wallet able to process conversions internally and maintain accurate balances for subsequent spending. Separately, a physical, in-person exchange of Japanese Yen was conducted at a HarbourFront location. The process was straightforward: the user approached the shop, entered the amount of Yen desired, and completed the payment via the app using a PayNow-style mechanism. After confirming the action, the user received the Japanese Yen promptly, underscoring the practical viability of the real-money exchange pathway offered by iChange. This real-world workflow demonstrates the platform’s capacity to bridge digital and physical channels, enabling travelers to choose the method that best fits their needs at any given moment.

A critical takeaway from these experiences is the importance of verifying the rate and the shop’s ability to fulfill the requested amount before finalizing an exchange. The app presents a curated list of rate options from different partner shops, and travelers should be aware that some shops may not have sufficient stock to complete a transaction, in which case they should select an alternative rate or location. This understanding ensures travelers maximize rate benefits while minimizing the risk of order failure. In addition, the ability to complete transactions via a mobile app with PayNow-type payment methods adds a convenient layer to the user experience, streamlining both digital and in-person exchanges.

In terms of currency breadth, iChange’s platform supports a broad set of well-traded currencies, including USD, JPY, KRW, MYR, and others that travelers frequently encounter. The inclusion of these currencies indicates a recognition of traveler needs and the demand for flexible access to foreign money through both digital wallets and real-world exchange channels. Users who frequently travel across Asia-Pacific markets are likely to find value in having a coordinated suite of tools—from currency exchange quotes to multi-currency wallet management and card-based spending—within a single app.

Overall, the digital wallet usage and the in-person exchange pathways offered by iChange provide travelers with a flexible toolkit for managing currencies. The combination of online purchasing with USD, offline exchange at partner shops, and a linked debit card offers a cohesive framework for handling day-to-day expenses while navigating the complexities of currency fluctuations. The real-world benefits lie in having rapid access to competitive rates, reduced friction in checkout, and the convenience of consolidating multiple financial activities under one platform.

Security, Fund Safety, and Regulatory Compliance

A central concern for any currency exchange and digital wallet platform is the safety and integrity of user funds. iChange emphasizes a secure architecture designed to protect customer assets through a regulated framework and established banking partnerships. According to the platform’s disclosures, user funds held within the iChange ecosystem are deposited into an account hosted by a licensed banking partner, specifically DBS Bank Limited, in association with SLIDESG PTE LTD. This arrangement falls under the oversight of the Monetary Authority of Singapore (MAS) as a Major Payment Institution, authorized and licensed under the Payment Services Act. The implication is that customer money is held in a regulated, safeguarded environment, separate from iChange’s operational accounts, providing a layer of protection against the risk of company insolvency impacting user balances.

Security measures extend to the card network side, where all card transactions are processed through established Mastercard processes and governed by Mastercard’s rules and standards. This ensures adherence to widely accepted security frameworks for card-present and card-not-present transactions, including fraud protection mechanisms and standardized dispute resolution pathways. The combination of a regulated bank arrangement and Mastercard-based processing is designed to reassure users about the resilience of funds and the integrity of transaction mechanics, both online and offline.

From a user perspective, these assurances translate into a practical sense of security when maintaining balances across multiple currencies. The segregation of funds in a regulated banking framework reduces the likelihood that user funds are co-mingled with the platform’s operational capital, which is a common risk factor in less-regulated or opaque setups. Additionally, the reliance on Mastercard for card transactions provides a familiar, trusted infrastructure that many travelers already rely on for secure payments worldwide. The regulatory alignment with MAS further reinforces compliance expectations, including consumer protections, data security, and auditing requirements that help sustain confidence in the platform over time.

Readers should consider these security features alongside typical risk-awareness practices, such as monitoring exchange quotes for accuracy, confirming merchant details before completing in-store exchanges, and ensuring that the e-wallet balance matches the intended spend. The platform’s emphasis on security and regulatory oversight is consistent with best practices in the fintech and payments space. While no system is entirely risk-free, especially when currency exchange is involved, iChange’s governance model and technical safeguards present a credible framework for safeguarding user funds and transactions.

In addition to the structural safeguards, travelers should remember to keep their app credentials secure, enable any available two-factor authentication, and review transaction histories regularly. These steps, combined with the platform’s formal safeguards, contribute to overall security for customers who rely on iChange for currency exchange and cross-border spending. The security narrative around iChange is anchored in regulated fund storage, authoritative payment networks, and a robust compliance posture, all of which are important considerations for users evaluating the platform’s trustworthiness and long-term viability.

Practical Tips, Considerations, and Limitations

Across the experiences with iChange, several practical tips emerge for users seeking to optimize their currency exchanges and ensure a smooth experience. First, when engaging with the rate quotes in the iChange app, it is important to remember that the platform displays multiple options from different partner shops. While this provides an opportunity to choose the best available rate, it also introduces potential variability, including stock limitations that may prevent immediate fulfillment. If a chosen shop cannot complete the exchange due to insufficient currency stock, users should promptly switch to the next best available option to minimize delays. This proactive approach helps ensure timely completion of exchanges, especially for travelers with time-sensitive itineraries.

Second, it is advisable to verify in advance whether the selected currency is readily available at the desired shop, particularly for less common currencies or larger amounts. In some cases, shops may require allocation time or may not be able to fulfill high-volume requests on demand. Travelers should factor this into their travel plans and allow for some flexibility in the choice of shop or rate. The app’s ability to present multiple quotes supports this strategy, enabling users to adapt to changing stock conditions and rate movements. The key is to stay informed about stock levels and to monitor the quotes closely during the decision-making process.

Third, for digital wallet usage in online purchases, users can leverage the wallet to pay for transactions denominated in specific currencies, such as USD, when the transaction occurs online. The wallet maintains balances in multiple currencies, providing a straightforward mechanism to fund purchases without a separate, separate exchange step at checkout. For travelers who frequently shop online in foreign currencies, this capability can simplify budgeting and reduce the number of steps required to complete a purchase. The digital wallet approach also allows for consistent tracking of spending across currencies, which can aid in personal finance management during international travel or cross-border shopping.

Fourth, the physical card adds a layer of convenience for in-person transactions, particularly in environments where card-based payments remain widely accepted or where cash handling is less desirable. The card operates in conjunction with the wallet balance, automatically drawing from the SGD balance when needed in Singapore, for example. This synergy between wallet management and card usage enhances everyday usability for travelers who want a unified spending experience without juggling multiple cards or cash. It is important to note that the card’s effectiveness hinges on the wallet’s currency balance and the availability of the currencies in the wallet to cover purchases.

Fifth, travelers should be mindful of ensuring sufficient local currency in their e-wallet before making purchases in a foreign country. The author’s anecdote about experiencing a poor exchange rate due to not having enough local currency in the wallet underscores the practical importance of proactive balance management. Before departure or upon arrival, users should top up or convert funds to the country’s currency to prevent suboptimal rate outcomes or transaction failures at the point of sale. Proactive balance management is a simple, prudent habit that can protect travelers from avoidable rate discrepancies and ensure smoother transactions.

Sixth, the onboarding and signup experience, while generally efficient, may include region-specific variations in verification workflows. While Singpass integration can streamline identity verification in some markets, users in other countries should be prepared for alternative verification methods. The onboarding experience is designed to be user-friendly while maintaining compliance with regulatory requirements, and new users should anticipate a brief waiting period for card issuance after successful sign-up. Users who encounter onboarding issues can typically resolve them by following the app’s guidance and verifying their personal information accurately.

Seventh, it is important to recognize that iChange’s rate quotes reflect real-world market dynamics tied to real currency shops. Rates can fluctuate as market conditions evolve, and the platform’s value proposition depends on presenting current quotes from partner shops. Therefore, users should consider rate stability when scheduling exchanges, especially for time-critical trips. Planning ahead and monitoring the app for updated quotes can help travelers lock in favorable rates and align their currency needs with their travel timelines.

Finally, while iChange presents a compelling combination of digital and physical currency exchange capabilities, users should remain mindful of the platform’s scope and currency coverage. The app’s catalog includes popular currencies, but there may be gaps for less common currencies or regions with limited partner shop networks. Travelers dealing with unusual currency needs should review the available currencies and the corresponding shops to ensure that they can meet their specific requirements. Regular engagement with the app’s features and staying aware of any changes to partner shop networks will help users maximize the platform’s benefits over time.

The Bigger Picture: Travel, Spending Confidence, and Market Position

The emergence of iChange reflects a broader trend in fintech where travelers demand more control over currency exchange, greater transparency around rates, and seamless integration between digital wallets and physical purchases. The platform’s hybrid approach—combining a digital wallet, real-world currency shops, a Mastercard-backed card, and cross-border payment capabilities—addresses several pain points that travelers commonly experience, including uncertain rate outcomes, the friction of exchanging cash at the wrong time, and the logistical challenges of carrying multiple currencies for everyday expenses. By offering a marketplace of real-world exchange options, iChange taps into a granular level of rate comparison that can yield meaningful savings for travelers who are sensitive to exchange costs and timing.

From a market-competitiveness standpoint, iChange competes with established players that provide digital wallets with currency conversion features built into the app, such as YouTrip and Revolut, while differentiating itself through direct connections to physical currency shops. The in-person exchange option can be particularly appealing to users who value immediacy and want to lock in a rate through a familiar shop environment. However, competitive dynamics in the currency exchange space mean that rate transparency, stock availability, and merchant acceptance are critical differentiators. The success of iChange depends on maintaining up-to-date quotes, robust inventory synchronization with partner shops, and a reliable user experience that can seamlessly switch between digital and physical channels.

This approach aligns with a broader consumer shift toward hybrid financial services that blend digital convenience with tangible, real-world services. For travelers who want to minimize cash handling while maximizing rate advantages, the iChange model offers a practical blueprint. The platform’s security framework and regulatory footing are also essential to building trust in a space where cross-border payments and foreign-exchange activities can raise concerns about fund safety and operational integrity. As iChange scales and expands its network of partner shops and currencies, its ability to maintain transparent, accurate quotes and reliable fulfillment will be central to sustaining user confidence and driving wider adoption among frequent travelers.

In conclusion, iChange presents a comprehensive, traveler-oriented financial ecosystem that merges a digital wallet with a real-world currency marketplace, a linked Mastercard debit card, and cross-border payment capabilities. Its strength lies in offering multiple rate options from partner shops, enabling users to optimize exchange conditions for both online and offline transactions. The onboarding process is designed to be efficient, with regulatory-backed safeguards intended to protect user funds and ensure secure transaction processing. While the platform demonstrates promising performance in terms of rate access, wallet versatility, and practical usage in both online and physical contexts, travelers should remain mindful of stock limitations, rate volatility, and the importance of maintaining sufficient local currency in their e-wallet to prevent unfavorable exchange experiences. This holistic approach to currency exchange and everyday spending positions iChange as a noteworthy option for travelers who seek greater control and clarity over their currency-related costs and spending abroad.

Conclusion

iChange offers a multi-pronged solution for travelers who want competitive, real-money exchange rates accessed through a digital wallet, with the option to complete exchanges physically at partner shops. Its integrated approach—spanning a multi-currency wallet, a Mastercard-powered card, overseas money transfers, and local plus overseas bill payments—aims to provide a seamless platform for cross-border finances. The pairing of digital quotes with actual shop fulfillment can yield tangible value in the form of better rates and more flexible spending options, particularly for those who frequently travel or transact in multiple currencies. While the platform shows strong potential, success for users depends on ongoing rate accuracy, consistent stock availability at partner shops, and timely onboarding that delivers both security and convenience. Travelers are encouraged to assess their own currency needs, monitor rate quotes, and plan their exchanges to capitalize on favorable conditions. Overall, iChange represents a compelling addition to the landscape of travel-focused fintech solutions, offering meaningful features that can simplify and optimize how users manage currencies and spend abroad.