Should You Buy, Sell, or Hold ETSY Stock After Its Q3 Earnings Report

As we approach the end of 2024, investors are eagerly awaiting the quarterly earnings reports from various companies. One such company that has been on our radar is Etsy (NASDAQ: ETSY). With its stock trading at $56.75 per share and a relatively flat return of 2.5% over the past six months, it’s essential to analyze whether this online marketplace is an attractive investment opportunity.

Get the Full Breakdown from Our Expert Analysts

Our team of expert analysts has put together a comprehensive breakdown of Etsy’s performance, highlighting both its strengths and weaknesses. Get access to our free report and make informed decisions about your portfolio.

Why We’re Sitting This One Out

After careful analysis, we’ve come to the conclusion that there are better opportunities available in the market right now. Here are three reasons why:

1. Active Buyers Hit a Plateau

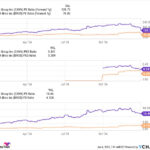

As an online marketplace, Etsy’s revenue growth heavily relies on increasing both its user base and average order size. However, over the last two years, the company has struggled to engage its active buyers, with numbers remaining flat at 96.71 million. This stagnation is concerning, especially considering the secular nature of internet usage.

What Does it Mean for Etsy’s Growth?

The fact that Etsy hasn’t been able to grow its user base suggests that the company may need to revamp its offerings or innovate new products to attract more customers. If not addressed, this plateau could hinder future growth and profitability.

2. EBITDA Margin Falling

Investors often analyze operating income to understand a business’s core profitability. Similarly, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a popular metric for consumer internet companies as it provides a more normalized view of profit potential by removing one-time or non-cash expenses.

Trend in Etsy’s Profitability

Analyzing the trend in Etsy’s profitability reveals that its EBITDA margin has decreased by 3.6 percentage points over the last few years. Although its historical margin is high, shareholders will want to see the company become more profitable in the future. The current trailing 12-month EBITDA margin stands at 27.4%.

3. EPS Growth Has Stalled

We track the change in earnings per share (EPS) as it highlights whether a company’s growth is profitable. Etsy’s flat EPS over the last three years, despite its 7.9% annualized revenue growth, indicates that the company became less profitable on a per-share basis.

What Does this Mean for Investors?

The stagnation in EPS growth suggests that investors may need to reassess their expectations from Etsy. With a relatively low valuation of 9.4× forward EV-to-EBITDA ($56.75 per share), it’s essential to weigh the potential risks and rewards before making an investment decision.

Final Judgment

While Etsy isn’t a terrible business, we don’t see a significant opportunity at the moment. If you’re looking for exciting stocks to buy, consider options like Google, whose cloud computing and YouTube divisions are firing on all cylinders.

Stocks We Would Buy Instead of Etsy

The elections are now behind us, and with rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year. Here are some top picks that could benefit immensely:

Our Top 5 Strong Momentum Stocks for this Week

Take advantage of the rebound by checking out our curated list of High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks That Made Our List in 2019

Some notable names on our list include Nvidia (+2,691% between September 2019 and September 2024) and under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.

As we conclude our analysis of Etsy’s performance post-Q3 earnings, it’s essential to remember that the online marketplace has its strengths and weaknesses. While it may not be a terrible business, we don’t see significant opportunities at the moment. If you’re looking for exciting stocks to buy, consider options like Google or explore our Top 5 Strong Momentum Stocks for this week.