How Investors Can Profit from the AI-Driven Data Center Boom

The digital engine of modern economies relies on data centers, the specialized real estate that houses the hardware powering cloud services, AI, and countless digital applications. While Europe plans for growth, recent analyses show a widening gap to the United States and China in absolute capacity. The demand for processing power is rising globally, with projections suggesting transformational increases in compute capacity by 2030, even as skeptics question the pace of ground-breaking AI models. Against this backdrop, leasing activity has surged, signaling a rapid shift in how organizations secure digital infrastructure and how investors view the data center market.

The Backbone of Digitalization: Data Centers as Critical Infrastructure

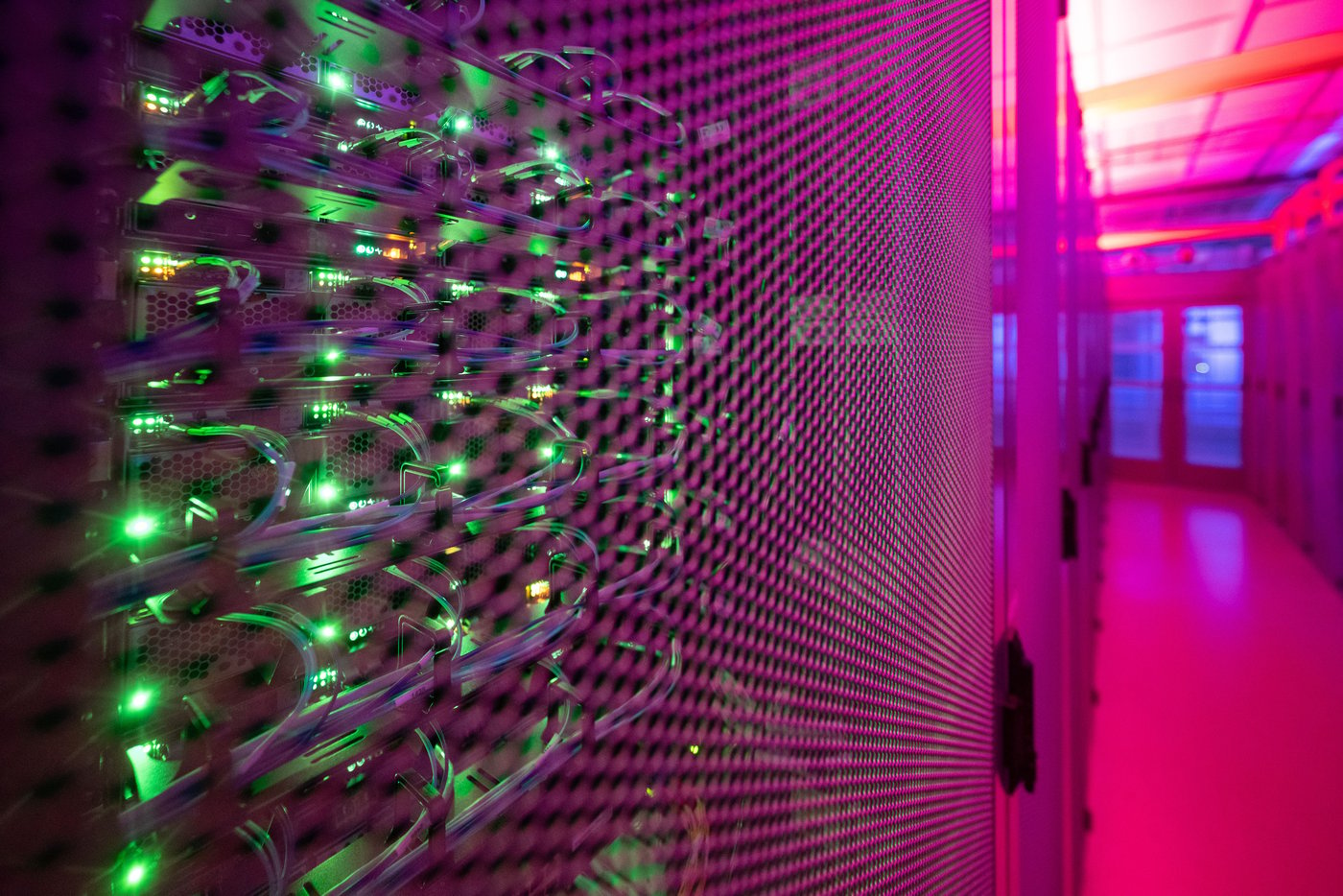

Data centers stand at the heart of the digital economy, serving as the physical backbone that enables cloud platforms, enterprise IT, and consumer services. These facilities house servers, storage, networking, and the power and cooling systems that keep them operational around the clock. They are far more than simple rooms filled with racks; they are interconnected ecosystems that require precise design, engineering, and governance to ensure reliability, security, and scalability. The role of data centers extends beyond processing data to enabling real-time analytics, AI inference, and global connectivity that underpins e-commerce, finance, healthcare, and public services. Their availability, latency, and resilience directly influence user experience and service performance.

In practice, data centers come in multiple flavors to serve different market needs. Hyperscale campuses support large-scale cloud providers and hyperscale enterprises, delivering massive compute capacity with shared infrastructure and efficient economies of scale. Colocation facilities offer interconnection-rich environments where multiple clients rent space, power, and cooling, leveraging a common infrastructure and favorable proximity to networks. Edge data centers, by contrast, are smaller facilities placed closer to end-users and devices to reduce latency and enable responsive services such as autonomous systems, real-time analytics, and location-based applications. The diversity of data center types is a key driver of the sector’s resilience and growth, as it allows both centralized scalability and localized processing where needed.

From an economic standpoint, data centers function as strategic assets for corporate and national interests. They enable cloud adoption, digital transformation, and AI initiatives that demand scalable and reliable compute resources. The energy footprint of data centers is a central consideration, driving ongoing optimization in power density, cooling efficiency, and the integration of renewable energy sources. In many markets, data centers operate as critical infrastructure, with industry participants collaborating with grid operators, regulators, and customers to ensure continuity of service, disaster recovery capabilities, and robust cyber and physical security. This combination of mission-critical status and technical sophistication makes the data center sector a focal point for investors, policymakers, and corporate technology strategy.

The technical design of modern data centers emphasizes reliability, security, and efficiency. Redundancy is common across power feeds, cooling paths, and networking, reducing single points of failure and enabling high uptime. Power supply architectures often incorporate multiple utility feeds, on-site generation options, and uninterruptible power systems that bridge to backup generators. Cooling solutions range from efficient liquid cooling to advanced air handling, all aimed at minimizing energy use while sustaining safe operating temperatures for dense equipment. Energy efficiency is quantified by metrics such as Power Usage Effectiveness (PUE), which guides operators toward lower total energy consumption relative to IT load while maintaining capacity for growth. Over time, data centers have evolved to incorporate modular design principles, enabling rapid scaling, easier maintenance, and faster site deployment, all of which contribute to a more agile digital infrastructure landscape.

Interconnectivity and proximity to network infrastructure are essential features of modern data centers. Strategic locations near fiber routes, internet exchanges, and customer markets reduce latency and improve performance for cloud and edge services. This interconnectedness also supports vibrant ecosystems of service providers, managed service firms, and satellite and content delivery networks, creating networks of collaboration that attract tenants seeking robust access to suppliers and customers. The ability to scale connectivity alongside IT capacity is a critical competitive differentiator for data center operators. As such, many facilities emphasize abundant cross-connects, carrier-neutral environments, and ecosystems that facilitate rapid deployment of new services or expansion of existing ones.

The strategic importance of data centers extends to national competitiveness and security. Governments recognize these facilities as essential for maintaining digital sovereignty, continuity of services, and the resilience of critical sectors such as finance, energy, and healthcare. As digital infrastructure becomes more embedded in daily life and national security strategies, investment in data center capacity, resilience planning, and secure operating environments gains prominence in policy discussions. Operators increasingly address risk management through diversified energy sourcing, climate risk mitigation, and robust incident response plans, ensuring continuity even amidst extreme weather events or grid disturbances. This convergence of economics, technology, and policy underscores why data centers are widely described as the backbone of digitalization and a central element of modern infrastructure planning.

The historical development of data centers has been shaped by evolving compute needs, cloud migration, and the expansion of AI and data-intensive services. As workloads shift toward machine learning, data analytics, and real-time processing, the demand for powerful, reliable, and scalable infrastructure intensifies. The sector has responded with innovations in hardware acceleration, cooling efficiency, automation, and software-defined management that optimize performance per watt, reduce operational risk, and lower total cost of ownership for tenants and owners alike. The result is a rapidly professionalizing market in which developers, operators, and investors pursue standardized, repeatable deployment methodologies, disciplined project financing, and rigorous performance benchmarking. All these dimensions reinforce the central message: data centers are not merely facilities; they are strategic platforms upon which the modern digital economy rests.

In reflecting on the broader implications, the data center sector emerges as a barometer of digital maturity and economic ambition. As companies deepen their reliance on cloud services, AI-powered workflows, and global data exchanges, the demand for reliable, scalable, and sustainable infrastructure continues to grow. This dynamic has profound consequences for real estate development, energy procurement, grid planning, and urban policy, all of which influence how communities and nations position themselves in a data-driven era. The coming years are likely to see intensified competition for capacity among leading markets, a shift toward more modular and distributed models of deployment, and a growing emphasis on resilience, energy efficiency, and responsible environmental stewardship as the sector navigates a transforming technological landscape.

Europe, the United States, and China: A Regional Outlook for Data Center Capacity

Europe’s data center market is undergoing a structured phase of expansion, with projected capacity growth intended to meet rising demand from cloud services, AI workloads, and enterprise digital transformation. Savills’ analysis suggests that European data center capacity could rise by approximately 21 percent by 2027, reaching about 13.1 gigawatts (GW) of total capacity. This projection indicates a measured but steady ramp-up that aligns with broader regional strategies to bolster digital sovereignty, strengthen connectivity, and expand cross-border data exchange to support business and public sector needs. The European market’s growth plan sits within a broader continental objective to maintain competitiveness in the global data center landscape, while also addressing energy mix, grid reliability, and environmental sustainability goals.

By contrast, the United States already hosts the world’s most expansive data center footprint, driven by a mature market, deep capital pools, and a dense concentration of hyperscale campuses. The U.S. currently holds roughly 48 GW of data center capacity, a level that reflects decades of development, robust demand from hyperscalers, and a well-integrated telecommunications infrastructure. The U.S. market’s scale affords it advantages in experimentation with novel deployment models, advanced cooling techniques, and rapid cycles of site selection and construction. The American market also benefits from a diversified energy landscape and a broad ecosystem of service providers and integrators, which collectively support continuous capability enhancements and resilience improvements.

In China, the current data center stock stands at about 38 GW, according to industry sources. China’s market is characterized by rapid growth, guided by a strong push in digital infrastructure to support nationwide initiatives in e-commerce, finance, manufacturing, and public services. The scale and speed of Chinese data center deployment are often linked to the pace of domestic cloud and AI activities, as well as the government’s strategic emphasis on data-intensive industries. The competitive dynamics in China are shaped by unique regulatory environments, energy planning, and local market conditions, which collectively influence how capacity expands and where new facilities locate within the country’s vast geography.

Across these major markets, several common drivers shape the regional outlook. The explosive demand for AI workloads, particularly in training and inference tasks, continues to push up the need for high-performance computing resources and robust network connectivity. The push toward edge computing and near-market data processing adds another layer of complexity, as operators seek to balance centralized hyperscale capacity with distributed, low-latency facilities. Grid reliability and energy costs remain critical success factors, influencing site selection, operating margin, and risk management. At the policy level, regulatory frameworks related to data privacy, energy procurement, and environmental standards influence where and how capacity is added, often favoring markets that offer clear and predictable rules, supportive permitting environments, and access to diverse energy sources.

The regional comparisons also highlight the differences in market maturity and growth rhythms. Europe’s growth trajectory is shaped by deliberate investment in cross-border connectivity, cyber resilience, and energy efficiency, with attention to sustainable development and climate objectives. The United States benefits from established ecosystems, fast permitting processes in many jurisdictions, and a continuum of public-private collaboration that accelerates project execution. China’s expansion is often driven by strategic national priorities and a robust domestic market for cloud services and AI, supported by policy guidance and large-scale capital outlays. These regional dynamics influence where capital flows, how quickly projects come online, and how capacity is allocated among cloud providers, colocation operators, and enterprise data centers.

Another layer to consider is the interplay between capacity growth and energy infrastructure. As data center footprints grow, demand for reliable power supply, cooling capacity, and resilient grid connections intensifies. In all regions, there is a trend toward integrating renewable energy sources and pursuing energy efficiency measures to reduce environmental impact while maintaining service reliability. This energy transition interacts with regional energy markets, price volatility, and regulatory incentives, shaping investment decisions and operating strategies for data center owners and tenants. The regional outlook, therefore, reflects a combination of market fundamentals, technology innovation, policy direction, and energy system evolution, all converging to determine how quickly and where data center capacity expands in the coming years.

Global Demand for Computing Power and the Growth of the Leasing Market

Global demand for computing power is rising at an unprecedented pace, driven by the intensifying use of cloud-native applications, data analytics, and artificial intelligence across sectors. A major benchmark comes from McKinsey Research, which projects that by 2030 the world will require an increase in computing capacity by a factor of 125. This projection, though subject to the uncertainties of AI model development, hardware breakthroughs, and efficiency gains, illustrates the scale of transformational growth anticipated in the data center ecosystem. If realized, the demand signal would place enormous pressure on supply to expand capacity, improve energy efficiency, and accelerate the deployment of new data center facilities around the world. The magnitude of this projected growth underscores the strategic importance of data centers as infrastructure capable of supporting dynamic workloads across industries and geographies.

The latest developments in AI, including the emergence of sophisticated models and increasingly capable AI systems, have a direct bearing on capacity planning. While some observers caution that the pace of progress, exemplified by new AI models, could be more moderate than early forecasts suggest, the market consensus remains that compute demand will grow substantially. The reason is simple: AI applications produce value by processing large datasets, training algorithms, and performing real-time inference across numerous use cases. The trend toward AI-enabled services in sectors such as healthcare, finance, manufacturing, and consumer technology is likely to sustain demand for data center capacity well into the next decade. Even as model complexity evolves, the underlying requirement for compute, memory, storage, and fast interconnectivity persists, reinforcing the central conclusion that data centers will continue to be indispensable infrastructure.

A striking indicator of the market’s velocity is the surge in global leasing activity for data centers. In the past three years, the leasing volume for data center space has risen by a multiple of seven, signaling a rapid reallocation of space and resources toward facilities capable of delivering reliable, scalable, and secure infrastructure for digital workloads. This sevenfold increase is not merely a sign of higher occupancy; it reflects a broader shift in how organizations obtain computing capacity. Rather than relying solely on owned assets, many enterprises, cloud providers, and service vendors increasingly turn to leased or colocated solutions to access flexible, scalable, and quickly deployable capacity. The changing leasing dynamics also reveal a preference for operators with robust interconnection options, sustainable energy strategies, and strong governance frameworks to manage operational risk and ensure continuity of service.

The leasing trend has several implications for the data center market. First, it accelerates the pace at which capacity comes online, compressing construction timelines and increasing competition for land, power, and water resources in strategic locations. Second, it influences pricing structures and occupancy strategies, as operators balance core space needs with adjacent services, such as network connectivity, peering arrangements, and managed services, to attract tenants. Third, it affects capital allocation and financing models, encouraging investors to pursue diversified portfolios with multiple geographies and asset classes, including hyperscale campuses, componentized modular data centers, and edge facilities. Finally, the trend highlights the importance of strategic partnerships and ecosystem development, as successful deployments depend on a wide range of stakeholders, from energy providers to equipment manufacturers and network operators.

From a strategic perspective, the global demand crescendo underscores the necessity for forward-looking infrastructure planning and risk management. Governments, developers, and operators must anticipate not only the pace of deployment but also the resilience and adaptability of the grid and energy markets. This includes evaluating the reliability of power supply during peak demand periods, the availability of cooling capacity in hot climates, and the stability of energy costs under volatile conditions. It also means ensuring that data center locations are resilient to climate-related risks, such as extreme weather events and rising temperatures, while maintaining proximity to network hubs and customer bases. The convergence of demand growth, technology maturation, and market dynamics reinforces the critical role of data centers as strategic assets in a digitally empowered global economy.

Market Dynamics, Financing, and Real Estate Implications

The data center market is undergoing rapid transformation in how capacity is financed, developed, and operated. The surge in demand, alongside the sevenfold growth in leasing activity, has reshaped financing models and investor interest. Traditional developers and real estate investment trusts (REITs) increasingly collaborate with specialized data center operators, private equity firms, and infrastructure funds to mobilize capital for large-scale, multi-site campuses. This collaborative approach enables risk sharing, access to diverse capital sources, and the ability to execute complex projects on accelerated timelines. The financing landscape has evolved to include a mix of equity investments, project-based loans, and structured finance arrangements that align with the long asset life cycles typical of data centers. As demand intensifies, lenders assess factors such as site selection quality, energy sourcing, flood and seismic risk, regulatory compliance, and the ability to secure stable power and cooling infrastructure.

Real estate markets for data centers are characterized by distinct dynamics compared to traditional office or retail sectors. Location selection emphasizes proximity to fiber networks, interconnection hubs, and customer ecosystems, rather than solely focusing on tenant demand for flexible office space. The value proposition for data center sites hinges on reliable energy supply, favorable interconnection terms, and growth-ready footprints that can accommodate modular expansion. Sovereign and municipal policies, zoning restrictions, and permitting timelines can significantly influence project schedules and costs. Operators must navigate regulatory regimes around energy procurement, carbon emissions, and environmental stewardship, all of which can affect cap rates, occupancy costs, and investment returns. The diverse needs of hyperscale tenants, colocators, and enterprise customers further complicate the market, requiring adaptable solutions, scalable footprints, and robust service-level guarantees.

In recent years, modular data centers and containerized solutions have gained traction as a response to demand volatility and the need for rapid deployment. These approaches offer faster time-to-market, reduced capital exposure, and greater flexibility to adjust capacity in response to shifting workloads. At the same time, the traditional model of large, single-site campuses continues to attract substantial investment, driven by scale economies, long-term occupancy commitments, and the ability to deliver comprehensive interconnection ecosystems. This dual path—modular, rapid deployment for agile capacity and large, purpose-built campuses for hyperscale needs—characterizes the current investment landscape and shapes planning for both developers and tenants.

The leasing market, in particular, reflects a broader trend toward flexible capacity and service-based models. Tenants increasingly seek not just space but an integrated package that includes power, cooling, security, network access, and managed services. This shift enhances the value proposition of data center operators who can deliver bundled solutions with predictable costs and performance outcomes. It also expands opportunities for service providers who can offer network connectivity, cloud on-ramps, and specialized IT services under a single umbrella. The result is a more dynamic market in which tenants can scale up or down with greater ease, while operators can monetize multiple streams of revenue, from core rack space to value-added services and interconnection fees. Such dynamics also influence the capital structure and risk management strategies of market participants, who must balance growth ambitions with prudent liquidity management, long-term energy procurement commitments, and resilience investments.

Policy and regulatory considerations are inescapable in shaping market dynamics. The classification of data centers as critical infrastructure has become a cornerstone in many jurisdictions, reflecting their importance for national economies and public services. This designation often brings heightened security requirements, continuity planning, and coordination with energy providers to ensure uninterrupted operation even during grid disturbances or emergencies. Environmental policies aimed at reducing carbon footprints push operators toward renewable energy procurement, on-site generation, and energy-efficient designs. While favorable incentives can accelerate capacity buildup, they can also add complexity to project planning and compliance. The negotiation of power purchase agreements (PPAs) and the integration of on-site generation capacity require careful financial modeling and risk assessment. In sum, market dynamics are influenced by a blend of demand fundamentals, capital markets, real estate considerations, and regulatory frameworks that collectively determine the pace, location, and modality of data center expansion.

Across the globe, the interplay between demand growth, financing capabilities, and real estate supply will continue to shape the trajectory of the data center market. Stakeholders must consider a spectrum of scenarios, including high-growth paths driven by AI and cloud adoption, as well as more cautious trajectories. The resilience of energy supply, the evolution of interconnection ecosystems, and the maturation of modular deployment techniques will be pivotal in deciding where capacity is added, how quickly, and under what business models. The leasing market, in particular, will remain a barometer of market sentiment and a mechanism by which capacity is mobilized to meet evolving workloads. Companies that anticipate demand, secure flexible and scalable deployments, and partner with reliable energy and network providers will be well positioned to capitalize on the opportunities the coming decade presents for data center investment and operations.

Energy, Sustainability, and Resilience in Data Center Operations

Sustainability and energy efficiency have become central to the business rationale for data centers. As compute workloads intensify and the demand for power grows, operators increasingly pursue aggressive energy management strategies to lower their environmental impact while preserving performance and reliability. Innovations in cooling, power optimization, and energy procurement are redefining the energy footprint of data centers, with ongoing emphasis on reducing greenhouse gas emissions, energy intensity, and water consumption. The industry’s commitment to sustainable practices aligns with broader policy objectives and corporate ESG priorities, reinforcing the importance of responsible development in the digital infrastructure sector. The conversation around energy also includes discussions about the share of renewables in the operating mix, the use of on-site generation such as solar or fuel cells, and the role of demand response programs to balance grid needs during peak periods.

Cooling remains a critical frontier for efficiency, particularly in hyperscale environments where dense racks generate significant heat loads. Advanced cooling approaches—ranging from liquid cooling and rear-door cooling to immersion cooling in some specialized cases—are evaluated for their efficiency gains, maintenance implications, and reliability considerations. These technologies are often deployed in concert with sophisticated environmental monitoring, hot-spot detection, and intelligent control systems to optimize airflow, temperature, and humidity across the facility. The goal is to minimize energy consumption while ensuring equipment longevity and performance stability, which translates into lower operating expenses and a reduced environmental footprint. In hot climates, effective cooling and energy management are especially important to sustain capacity growth without compromising reliability or incurring prohibitive energy costs.

Power supply strategy is another pillar of sustainability. Data centers typically rely on multiple power feeds, robust uninterruptible power systems (UPS), and standby generation to guarantee uptime even in the event of grid disruption. The choice of energy procurement, whether through long-term PPAs, power purchase agreements, or direct utility purchases, influences both cost and sustainability outcomes. As markets pursue deeper decarbonization, operators increasingly pursue diversified energy portfolios that include wind, solar, and other low-carbon sources, often complemented by energy storage solutions to smooth fluctuations in supply. The ability to forecast, manage, and optimize energy procurement is integral to long-term financial performance and environmental stewardship.

Beyond energy, water management and landscape optimization contribute to sustainability goals. Cooling systems can require significant water resources, so operators evaluate water usage intensity, recycling capabilities, and local water availability to ensure responsible stewardship. In arid regions and areas facing water scarcity, this consideration becomes a central factor in site selection and design. By combining efficient cooling technologies, renewable energy integration, and responsible water practices, data centers can achieve stronger sustainability credentials while maintaining or improving uptime and performance.

The resilience dimension of data center operations is inseparable from sustainability. Facilities must be designed to withstand environmental risks such as floods, storms, heat waves, and seismic events, which are increasingly relevant in the context of climate change. This resilience includes robust physical security, redundant power and cooling paths, and disaster recovery planning that preserves critical services under adverse conditions. Operators invest in risk assessment, backup capacity, and rapid restoration capabilities to minimize downtime and ensure that essential services remain available during emergencies. The resilience framework extends to cyber resilience as well, with layered cybersecurity controls, threat intelligence sharing, and incident response protocols to protect data and maintain service continuity in the face of evolving cyber threats.

Sustainability and resilience are not only operational concerns; they impact strategic decisions about location, capital allocation, and long-term value creation. Markets that emphasize energy efficiency, renewable integration, and resilient infrastructure tend to attract more capital and offer lower operating costs, contributing to more favorable financial performance and risk profiles. Investors increasingly scrutinize sustainability metrics, procurement arrangements, and vendor partnerships when evaluating data center opportunities. Consequently, the industry’s evolution toward greener, more resilient practices not only aligns with environmental objectives but also reinforces the business case for data centers as durable, essential infrastructure for the digital economy.

Grid Integration, Energy Security, and Reliability

As data center capacity expands, the relationship between data centers and the electrical grid becomes increasingly critical. Data centers are power-intensive facilities whose operations can influence and be influenced by grid conditions. The need for stable, high-quality electricity with minimal interruptions heightens the importance of reliable grid access, robust substation capacity, and secure power delivery. Utilities, regulators, and data center operators must collaborate to ensure that capacity expansion aligns with grid modernization efforts and that any additional demand is met with credible planning, appropriate pricing signals, and diversified energy sources.

Grid integration involves coordinated planning around peak demand, capacity margins, and demand-side flexibility. Data centers can participate in demand response programs, temporarily reducing power use during grid stress to help stabilize overall system reliability. This collaboration supports both data center resilience and grid stability, creating efficiencies and value for both sides of the equation. The deployment of on-site generation assets, energy storage, and advanced energy management systems further strengthens the ability of data centers to operate reliably in the face of grid volatility and weather-related disruptions. Such capabilities are particularly advantageous in regions with high energy price volatility or less developed transmission networks.

Energy security is a growing priority for data center operators, especially for environments that rely on imported energy or face geopolitical risks. Diversification of energy procurement, long-term PPAs with varied partners, and the potential for on-site generation provide avenues to reduce exposure to supply disruptions and price spikes. Operators assess risk across multiple dimensions: generation capacity, transmission reliability, regulatory stability, and the financial health of energy suppliers. In parallel, regulators and policymakers consider strategic energy reserves, grid resilience investments, and incentives for low-carbon energy sources to bolster national energy security while enabling digital infrastructure growth.

Reliability is the cornerstone of data center operations. Consumers and enterprises rely on continuous service, and even brief outages can incur substantial costs for tenants and operators. The reliability of the power supply is therefore a primary performance metric, with uptime targets and restoration timelines embedded into service-level agreements and performance guarantees. Operational practices such as rigorous preventive maintenance, spare parts readiness, and proactive replacement of aging infrastructure contribute to minimizing unplanned downtime. The result is a system in which data center operators pursue both high reliability and energy efficiency, balancing the competing demands of cost, environmental stewardship, and service quality.

The economic and strategic implications of grid integration for data centers are significant. Regions with reliable, affordable electricity and supportive regulatory environments are more likely to attract investment in new capacity. Conversely, markets that experience energy price volatility, supply constraints, or uncertain policy direction may see more cautious expansion or selective deployment of capacity. In this context, the ability to integrate renewables, storage, and flexible demand management becomes a competitive differentiator for data center operators. The sector’s future growth will depend on continued improvements in grid infrastructure, energy policy clarity, and the development of robust, cross-border interconnections that enhance reliability and enable more efficient distribution of capacity to where it is needed most.

Innovation, Edge Computing, and the AI-Driven Future

Innovation remains a central driver of the data center landscape, particularly as artificial intelligence and advanced analytics become pervasive across industries. As workloads demand ever-greater compute density and faster data movement, operators and technology providers pursue architectural innovations that improve performance, efficiency, and cost-effectiveness. Edge computing complements the growth of hyperscale data centers by bringing processing closer to end-users and devices, reducing latency for latency-sensitive applications and enabling new business models in areas such as autonomous systems, real-time monitoring, and immersive experiences. The convergence of edge and cloud architectures requires a flexible, interconnected data center ecosystem capable of supporting diverse workloads and shifting workloads between centralized and distributed facilities as needed.

The AI revolution is not only about the deployment of new hardware; it also involves software innovations, data governance, and robust data infrastructure. High-performance computing (HPC) advancements, specialized accelerator chips, and optimized software stacks enable more efficient model training and inference. The increased reliance on AI accelerators and advanced memory technologies pushes data centers to explore higher-density configurations, novel cooling strategies, and efficient integration of heterogeneous computing resources. These developments drive demand for sophisticated power and cooling infrastructure, as well as advanced interconnect networks to minimize communication bottlenecks and maximize throughput. The combination of hardware, software, and data management innovations fuels a virtuous cycle of increased compute capacity and capability, reinforcing the strategic importance of data centers as engines of digital transformation.

The economic implications of AI and edge computing for data centers are substantial. AI workloads can deliver significant business value, but they also demand specialized equipment, robust cooling, and careful capacity planning. Edge deployments, with their smaller footprints and proximity to users, require modular, scalable designs that enable rapid deployment and efficient use of local resources. As a result, the market is witnessing a diversification of asset classes, deployment models, and monetization strategies, with operators delivering blended offerings that combine space, power, connectivity, and managed services. The evolving AI and edge ecosystems thus shape the demand profile for data centers, influencing site selection, financing, and operations in ways that reflect a broader shift toward intelligent, networked infrastructure.

A key strategic question for market participants is how to balance growth with risk management in a volatile technology landscape. The sevenfold rise in leasing activity over three years demonstrates a willingness to embrace flexible, scalable capacity, but it also signals heightened market sensitivity to shifts in demand, supply chain disruptions, and macroeconomic conditions. Investors and operators must evaluate potential scenarios across capacity growth, energy costs, policy changes, and technology innovation. Strong governance, diversified revenue streams, and resilient, sustainable design will be essential to sustain long-term value creation in an environment characterized by rapid technological change and evolving customer expectations. As the data center industry continues to mature, stakeholders will increasingly rely on disciplined planning, rigorous risk assessment, and strategic partnerships to navigate the complexities of a fast-changing digital infrastructure landscape.

The Competitive Landscape: Operators, Investors, and Ecosystem Partners

The data center sector has entered an era of heightened competition among hyperscale operators, hyperscale tenants, and specialized colocation providers. The competitive dynamics hinge on several factors, including scale, energy efficiency, network interconnection capabilities, and location strategy. Operators with large, diversified footprints can leverage economies of scale to optimize capital expenditure, drive lower operating costs, and offer tenants broad interconnection ecosystems. Colocation providers, meanwhile, emphasize flexibility, service quality, and proximity to customer markets, delivering modular and scalable solutions that appeal to a range of clients seeking reliable infrastructure with predictable costs. The balance between hyperscale capacity and local, edge-enabled services shapes the market, influencing strategic decisions about where to deploy new capacity, how to price services, and how to manage risk.

Financing the sector requires sophisticated approaches that recognize the long asset life of data centers and the cyclical nature of demand. Access to capital has become more diverse, with traditional real estate financing blending with infrastructure funds, private equity, and structured finance solutions tailored to data center characteristics. The evolving capital markets reward operators that demonstrate strong governance, transparent performance metrics, and clear pathways to accelerated deployment. Investors focus on portfolio diversification, risk-adjusted returns, and the ability to monetize value-added services such as interconnection and managed services, alongside core rack space. This multi-faceted financing environment supports expansive growth while reinforcing the importance of prudent risk management and robust operational discipline.

Ecosystem partnerships are crucial for the data center industry. Operators collaborate with energy providers to secure reliable power and integrated renewables, with network carriers to ensure diverse, high-capacity interconnects, and with technology vendors to deploy cutting-edge hardware and software solutions. These collaborations create a more resilient and flexible service offering, enabling customers to optimize performance, reduce latency, and achieve sustainability goals. The ecosystem also includes modular construction specialists, who provide rapidly deployable data center components, and service integrators who deliver end-to-end solutions that range from design and build to ongoing operations and optimization. A healthy ecosystem accelerates deployment, improves service quality, and enhances the ability of data centers to adapt to evolving technology landscapes and customer needs.

From a macro perspective, the data center market reflects broader trends in digital transformation, cloud adoption, and the globalization of IT infrastructure. The growth of cloud services, AI-enabled applications, and data-driven business models encourages ongoing investment in capacity expansion and upgrades. The market’s future trajectory will be shaped by policy stability, energy prices, and regulatory alignment across regions, as well as the speed at which new technologies can be integrated into existing facilities. Stakeholders that prioritize scalable, energy-efficient, and interconnected infrastructure, supported by robust governance and diverse financing, will be well positioned to capture opportunities arising from the sector’s ongoing evolution.

Policy and Regulatory Landscape: Implications for Growth and Resilience

The policy environment surrounding data centers is a critical determinant of market growth, resilience, and sustainability. Many regions classify data centers as essential infrastructure, emphasizing their role in enabling critical services, financial systems, healthcare, and government activities. This designation carries implications for security standards, contingency planning, and collaboration with energy providers to ensure continuity of service under adverse conditions. Regulators also focus on ensuring that data centers adhere to cybersecurity norms, privacy protections, and secure data-handling practices, given the sensitive information stored and processed within these facilities. The interplay between security requirements and innovation is intricate, requiring ongoing alignment between industry practices and policy expectations to avoid slowing deployment while maintaining strong protections.

Energy policy and electricity market design are particularly influential in shaping data center expansion. Regions that offer predictable and favorable energy pricing, transparent procurement rules, and reliable grid access create an environment conducive to building large, long-term capacity. Conversely, areas facing energy price volatility or grid constraints may introduce greater project risk, potentially slowing deployment or prompting a shift toward more modular, distributed deployment strategies. Governments also increasingly emphasize decarbonization targets and the integration of renewables, carbon pricing, and energy storage, creating a policy landscape that rewards efficient design, clean energy procurement, and innovative demand management solutions within data centers.

Permitting, zoning, and land-use regulations are practical constraints that can affect project timelines and costs. The data center sector often requires special zoning considerations due to its energy and cooling needs, access to fiber networks, and environmental impact. Streamlined permitting processes, predictable timelines, and clear environmental compliance standards can accelerate deployment, while complex or opaque procedures can add cost and delay. Smart regulatory design that balances environmental protection with the urgent need for digital infrastructure helps create favorable conditions for investment, particularly in markets where digital transformation is a national priority.

The regulatory environment also intersects with environmental, social, and governance (ESG) expectations. Data centers are increasingly scrutinized for their energy efficiency, carbon footprint, and water usage, encouraging operators to pursue transparent reporting and credible sustainability strategies. Policymakers are watching for meaningful progress in energy procurement, waste heat reuse, and renewable integration, recognizing that sustainable data centers can deliver long-term value for communities and economies. As data centers become more central to national development plans, regulatory frameworks that promote efficiency, resilience, and sustainability will help ensure that capacity expansion aligns with broader societal goals while maintaining investor confidence and market dynamism.

Investment, Development, and Strategic Planning in a Rapidly Evolving Market

The data center investment landscape has become more sophisticated as liquidity and demand for capacity grow. Developers and operators pursue a mix of funding strategies, combining equity investments, debt financing, and project-level financing to support multi-site developments and complex builds. The ability to mobilize capital quickly, structure long-term financing terms, and manage costs is essential to meeting aggressive deployment timelines while maintaining financial discipline. Investors evaluate a range of risk factors, including site risk, power availability, cooling capacity, supply chain resilience, and the enforceability of contractual arrangements with tenants and service providers. A disciplined approach to due diligence and risk management is essential in an environment characterized by rapid change and high capital intensity.

Location strategy remains a central driver of value. Markets with strong connectivity, access to diverse energy sources, and supportive regulatory regimes can command premium valuations and attract more investment. Conversely, sites with grid vulnerabilities, permitting bottlenecks, or energy price volatility may carry higher risk premia and longer time-to-market. The economic calculus involves balancing land costs, construction expenses, and operating costs against expected rental income, interconnection opportunities, and potential revenue from value-added services. As data center ecosystems mature, investors seek opportunities that combine scale with flexibility, enabling diversified revenue streams through interconnection services, managed offerings, and multi-tenant arrangements.

Modular and prefab construction methodologies contribute to faster delivery and lower capital exposure, enabling developers to respond to surging demand and changing workloads. By standardizing components and leveraging repeatable design patterns, modular approaches can shorten construction timelines, reduce on-site risk, and improve cost predictability. The trade-off is ensuring that modular solutions meet stringent reliability and performance standards and can be integrated with existing infrastructure without compromising security or operational efficiency. The ability to combine modular deployment with conventional builds provides a practical route to scale while maintaining quality and resilience.

Strategic partnerships and ecosystem collaboration underpin success in the data center market. Relationships with energy providers, technology vendors, network operators, and service integrators enable holistic offerings that attract tenants seeking bundled capabilities. Partnerships help secure favorable terms for power, cooling, and connectivity, while also enabling joint ventures that distribute risk and accelerate project delivery. A well-managed ecosystem approach can deliver competitive advantages through enhanced capacity, reliability, interconnection density, and a diversified set of services that align with tenant needs across enterprise, cloud, and public sector segments.

Future growth in data centers will depend on several interrelated factors: continued demand for cloud services and AI workloads, advancements in cooling and energy efficiency, diversification of energy sources, and a policy environment that supports sustainable, secure, and scalable digital infrastructure. As markets worldwide seek to align with climate goals and energy security priorities, the data center sector must balance rapid capacity expansion with responsible stewardship and prudent financial management. Operators who align capital strategies with technology innovation, energy considerations, and robust risk controls are best positioned to capitalize on the opportunities of the coming decade, while maintaining resilience in the face of evolving regulatory and market conditions.

The Global Outlook: Opportunities and Challenges Ahead

Looking ahead, the global data center landscape presents both substantial opportunities and notable challenges. The opportunities stem from the enduring demand for digital services, cloud adoption, AI, and the expansion of the digital economy across sectors and geographies. Regions that can efficiently grow capacity, access diverse energy sources, and provide predictable regulatory environments are likely to attract a broad set of investors, developers, and tenants. The ability to deliver high-density compute, robust interconnection, and sustainable operations will be a differentiator in a market characterized by intense competition and rapid technological change. The data center industry’s capacity to scale sensitively to changing workloads will be a cornerstone of strategic planning for enterprises and policymakers alike.

Nevertheless, the challenges are significant and multifaceted. Energy prices, grid reliability, and environmental constraints remain central concerns for expansion plans. The availability of land and water resources for cooling, as well as the need to maintain uptime, makes site selection a complex balancing act that requires careful analysis and forward-looking risk assessment. Permitting delays, regulatory complexity, and port-to-site logistics can extend development timelines and increase costs, affecting the overall project economics. The industry must also navigate evolving cyber threats and stringent security requirements, which require ongoing investments in security measures, monitoring, and incident response capabilities.

In this context, ongoing collaboration among data center operators, energy providers, regulators, and technology suppliers will be essential to unlock capacity growth while maintaining resilience and sustainability. The market’s evolution will be shaped by the ability to implement innovative design and construction methods, to optimize energy use, and to create interconnected ecosystems that deliver reliable, scalable, and cost-effective solutions to tenants. The outcome will depend on a combination of market fundamentals, policy direction, technological progress, and investor confidence. As digital workloads become more pervasive and critical to everyday life, the data center industry will continue to play a central role in enabling this transformation, while also facing the imperative to do so in a way that promotes environmental responsibility, energy security, and social value.

Conclusion

Data centers are the backbone of digital infrastructure, enabling the cloud, AI, and countless digital services that define modern life. Their role as critical infrastructure is underscored by their impact on reliability, security, and economic competitiveness, as well as their integration with energy systems and policy ecosystems. Europe’s projected capacity growth, while meaningful, sits against the backdrop of the United States and China, where current capacity and expansion momentum are more pronounced. The global demand for computing power is expected to rise substantially, with projections of dramatic increases in compute capacity by 2030, even as the pace of AI breakthroughs remains a topic of debate. The sevenfold increase in leasing activity over a three-year period highlights a market undergoing rapid transformation, driven by the need to access scalable, flexible, and interconnected infrastructure to support diverse workloads.

The regional dynamics, including the 21 percent Europe-wide capacity growth anticipated through 2027 to about 13.1 GW, the United States’ 48 GW, and China’s 38 GW, illustrate how capacity expansion will unfold across markets with distinct regulatory, energy, and market characteristics. The industry’s trajectory will be shaped by a mix of demand fundamentals, financing dynamics, real estate strategies, and regulatory frameworks that either accelerate or constrain deployment. The ongoing push toward AI-driven workloads, edge computing, and interconnection ecosystems will require data centers to be designed and operated with an emphasis on resilience, energy efficiency, and sustainability.

Sustainability, energy security, and grid reliability will remain central to any forecast for growth. As data centers scale, they must balance performance with environmental stewardship, leveraging renewable energy, efficient cooling, and innovative energy management. Policy choices and permitting processes will significantly influence project timelines and feasibility, while market dynamics around leasing, ownership, and interconnection will shape investment strategies and the pace of deployment. Stakeholders across the industry—developers, operators, investors, policymakers, energy providers, and technology suppliers—must engage in collaborative planning to ensure that capacity grows in a way that supports digital transformation while minimizing risk and maximizing societal value.

In sum, data centers will continue to be a defining element of economic development in the digital era. Their evolution will reflect a complex interplay of technological advancement, market demand, financial engineering, regulatory clarity, and sustainable practices. As the world increasingly relies on data-intensive services, the strategic importance of data centers will only intensify, reinforcing their role as the essential infrastructure that powers the modern information economy. The path forward will demand disciplined, collaborative action and a clear focus on resilience, efficiency, and responsible growth to meet the needs of a data-driven future.