New Report Confirms Europe’s Tech Investment Doldrums but Reveals Signs of Revival

The European Tech Investment Party Hangover: A Closer Look at 2023 Trends

A Mixed Bag for Europe’s Startups

Europe is still reeling from the aftermath of the tech investment party that took place in 2020-2021. While venture capital (VC) investment in European startups has reached a new high, with a total of $61.8 billion raised last year, according to a report by global law firm Orrick, the current trend is not all sunshine and rainbows.

A Record-Breaking Year, But…

The report reveals that despite reaching record levels of VC investment, Europe’s startup ecosystem still faces significant headwinds. The anomaly created by the surge in investment during the pandemic has led to a correction in investment levels globally, with 2023 marking a major reset.

Interestingly, out of the top three global regions for VC – Europe, Asia, and North America – Europe is the only one that exceeded 2019 levels in 2023. However, this growth comes with its own set of challenges.

Challenges Ahead

The report highlights several key trends that are shaping the European startup ecosystem:

- Funding remains slow: Despite record-breaking investment, funding for startups remains slow.

- Unicorns under pressure: Only 11 new unicorns emerged from Europe last year, the fewest in a decade. Meanwhile, a growing number of unicorns lost their status.

- Climate tech takes center stage: Climate tech overtook fintech as Europe’s most popular sector.

- AI’s rising share: AI’s share of total investment in Europe soared to a record high of 17%.

Investors Take Control

The report also notes that investors are becoming more cautious, exercising greater control over investments. Founders are now required to stand behind warranties in 39% of venture deals, indicating a shift towards more stringent due diligence.

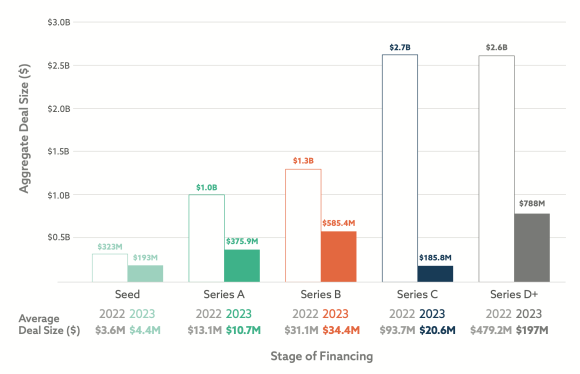

Deal Volume and Stage Financing Trends

At each stage, deal value is down, with the most dramatic fall in later-stage deals. Early-stage deal value dropped by 40%, despite early-stage investors remaining the most active. There was also a decline in ‘mega-rounds’ exceeding $100 million-plus.

However, there are signs of life in the IPO landscape, with ARM’s $55 billion IPO and M&A activity showing ‘green shoots’.

Regional Trends

The report highlights regional trends that are shaping the European startup ecosystem:

- UK: VCs are under pressure to deliver returns, leading to increased demand for secondaries, greater M&A activity, and consolidation.

- France: A shift from ‘founder-friendly’ terms towards more investor-friendly terms is underway.

- Germany: Growing demand from Limited Partners (LPs) for liquidity is expected to ‘energize the tech M&A pipeline’.

Conclusion

While Europe’s startup ecosystem has reached new heights in terms of VC investment, the current trend is not without its challenges. Founders and investors must navigate a complex landscape, with funding remaining slow and unicorns under pressure.

However, there are also opportunities for growth, particularly in climate tech and AI. By understanding these trends and regional differences, startups can position themselves for success in the ever-changing European startup ecosystem.