Super.com plans to launch a new savings app through equity and debt financing of $85 million.

Introduction

The current inflation environment has forced everyone to seek ways to cut costs and save money. Among the innovative companies tackling this challenge, Super.com (formerly Snapcommerce) stands out as a leader in empowering users with tools to manage their finances effectively. Launched in October 2022, SuperCash, its innovative cashback card, has already amassed over 5 million customers worldwide, amassing a collective savings of over $150 million.

The Vision of Super.com

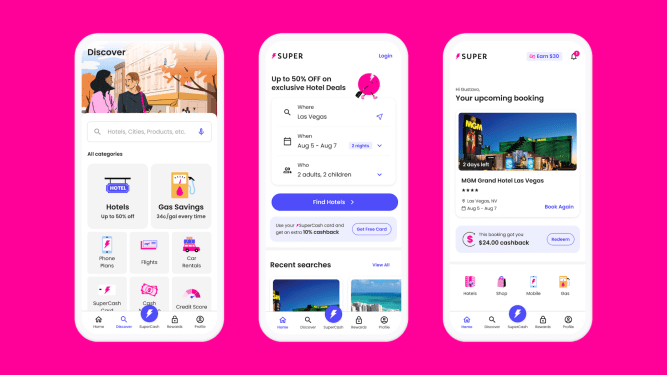

Super.com’s mission is to help ‘everyday Americans’ find deals and savings across multiple categories, including travel and shopping. The company aims to revolutionize personal finance management by providing users with the tools they need to save money effectively. With its innovative app, SuperHelp, users can monitor their spending, track cashback offers, and manage their budgets in real-time.

The Expansion of Super.com’s Features

SuperCash has quickly become a popular tool for everyday transactions, offering users an immediate way to save money on their purchases. For every eligible purchase made using the app, users receive cashback directly deposited into their bank accounts or credit cards. This feature is particularly useful for those looking to manage their budgets and reduce their expenses.

In addition to SuperCash, Super.com has expanded its product line to include other innovative financial tools designed to enhance user experience. For example, the company’s SuperCard provides users with a pre-approved credit line based on their spending habits and transaction history. This feature is particularly useful for those looking to build their credit scores or manage unexpected expenses.

The Growth of Super.com

Since its launch in October 2022, Super.com has gained significant momentum in the personal finance market. With over 5 million users and a collective savings of $150 million, the company is poised to become one of the leading providers of financial management tools. The success of SuperCash is attributed to its user-friendly interface, competitive cashback rates, and the ability to track spending in real-time.

The Expansion into New Markets

Super.com has quickly expanded its market reach by targeting new customer segments. For instance, the company has launched a travel-focused app that provides users with cashback rewards on eligible travel expenses. This feature is particularly useful for frequent travelers looking to save money on their trips.

In addition to SuperCash and SuperCard, Super.com has introduced a range of other financial tools designed to meet the needs of its customers. For example, the company’s SuperSavings app provides users with access to high-yield savings accounts that are tied directly to their spending patterns. This feature is particularly useful for those looking to grow their savings over time.

The Impact of Super.com on Personal Finance Management

The rise of Super.com has had a significant impact on personal finance management, particularly in the areas of budgeting and saving money. With its innovative tools, the company has made it easier for users to track their spending, save money effectively, and manage their budgets in real-time.

One of the key features of Super.com is its ability to provide users with real-time feedback on their spending habits. For example, the app provides users with a detailed breakdown of their monthly expenses, including where they are spending their money and how much they can potentially save. This feature is particularly useful for those looking to create a budget that works for them.

The Role of Investors

Since its launch in October 2022, Super.com has attracted significant investment interest from a range of investors. With an estimated valuation of $1 billion as of mid-2023, the company is poised to continue its growth trajectory. A number of prominent investors have expressed interest in Super.com’s innovative financial management tools, including Inovia Capital, Accel Partners, and Sequoia Capital.

In addition to attracting investment capital, Super.com has also secured a range of strategic partnerships with leading financial institutions. These partnerships have helped the company expand its market reach and enhance its financial management tools. For example, Super.com has partnered with Mastercard to provide users with access to cashback rewards on eligible purchases made using their credit cards.

The Future of Super.com

As Super.com continues to grow, there are a number of exciting opportunities for investors and partners alike. The company’s innovative financial management tools have already captured a significant market share in the personal finance management space, but there is still room for further growth.

With its focus on user experience, competitive cashback rates, and real-time feedback on spending habits, Super.com is well-positioned to continue its dominance in the personal finance management market. The company’s ability to expand into new markets, including travel and lifestyle categories, will also help it to further enhance its customer base and revenue streams.

Conclusion

Super.com’s innovative financial management tools have already made a significant impact on the way people manage their budgets and save money. With its focus on user experience, competitive cashback rates, and real-time feedback on spending habits, Super.com is poised to continue its growth in the personal finance management space. As the company continues to expand its product line and target new customer segments, it will be interesting to see how it positions itself in this competitive market.

References

- Duolingo sees 216% spike in US users learning Chinese amid TikTok ban and move to RedNote

- Tesla to split $100M award for electric truck charging corridor in Illinois

- Bluesky is getting its own photo-sharing app, Flashes

- Colossal Biosciences raises $200M at $10.2B valuation to bring back woolly mammoths

- UnitedHealth hid its Change Healthcare data breach from customers for over a year

Acknowledgments

The author would like to extend their gratitude to the following individuals and organizations for their support and contribution to this article: